Dan Quayle is best known as the 44th Vice President of the United States, serving under President George H. W. Bush from 1989 to 1993.

While his political career often draws public attention, far less discussed is how he built his wealth after leaving public office.

As interest in political figures’ finances continues to grow, many readers are asking one key question: what is Dan Quayle’s net worth today?

Unlike many politicians whose earnings peak during their time in government, Quayle’s financial success accelerated after politics. Through strategic moves into private equity, corporate advisory roles, and long-term investments, he transformed his public service background into substantial private-sector wealth.

This article provides a comprehensive breakdown of Dan Quayle’s net worth, exploring his income sources, assets, post-political career, and how his wealth compares to other former U.S. vice presidents.

By the end, readers will have a clear, fact-based understanding of how Dan Quayle built and sustained his fortune.

Dan Quayle’s Early Life and Financial Background

Dan Quayle was born on February 4, 1947, in Indianapolis, Indiana, into a family with strong business and media ties. His background played an important role in shaping both his early opportunities and long-term financial foundation. Quayle’s family was connected to the newspaper industry, owning and operating several regional publications in Indiana and Arizona. This exposure gave him early insight into business operations, management, and the value of long-term investments.

He attended DePauw University, where he earned a bachelor’s degree, followed by a law degree from Indiana University’s Robert H. McKinney School of Law. During these formative years, Quayle benefited from financial stability that allowed him to focus on education, networking, and public service rather than immediate income generation. While he did not amass significant wealth early in life, his family background provided a level of financial security uncommon among many future politicians.

Before entering national politics, Quayle served in the Indiana Army National Guard and briefly practiced law. These roles offered modest income but helped establish his professional credibility. More importantly, they positioned him for a rapid entry into politics at a young age. At just 29, he was elected to the U.S. House of Representatives, marking the beginning of a long political career.

Although Dan Quayle’s early life did not make him wealthy outright, it laid the groundwork for future financial success. His education, family connections, and early exposure to business and media created advantages that later translated into lucrative opportunities once he transitioned from public office to the private sector.

Early Political Career and Entry Into National Office

Dan Quayle’s financial profile began to take shape with his rapid rise in national politics. In 1976, at just 29 years old, he was elected to the U.S. House of Representatives, becoming one of the youngest members of Congress at the time. As a congressman, Quayle earned a government salary that, while respectable, was modest compared to private-sector earnings. During this period, his income was largely limited to his congressional pay and minor investment returns.

In 1980, Quayle advanced to the U.S. Senate, further increasing both his public visibility and earning potential. Senators received higher compensation, along with enhanced benefits and greater access to influential political and business networks. While federal ethics laws restricted outside income, Quayle was still able to maintain and grow personal investments through managed accounts and family assets.

Financial disclosure reports from this era suggest that Quayle lived comfortably but not extravagantly. Like many career politicians, his wealth accumulation during these years was steady rather than dramatic. The true value of his Senate tenure was not immediate income, but the long-term connections he developed with corporate leaders, policymakers, and investors.

Quayle’s national prominence peaked when he was selected as George H. W. Bush’s running mate in the 1988 presidential election. The campaign itself did not significantly increase his net worth, but it elevated his profile on a global scale. This visibility would later prove critical in opening doors to lucrative private-sector roles after his time in public service ended.

Overall, Dan Quayle’s early political career established financial stability, credibility, and access key ingredients that would later fuel the substantial growth of his net worth beyond government service.

Vice Presidency and Government Compensation

Dan Quayle served as Vice President of the United States from 1989 to 1993, a role that brought prestige but limited financial upside. During his term, the vice presidential salary was set by the federal government and, while higher than most congressional roles, it was modest compared to executive-level private-sector compensation. In addition to salary, Quayle received official benefits such as housing allowances, travel coverage, and full-time security, which reduced personal expenses but did not directly increase net worth.

Federal ethics laws significantly restricted outside income for sitting vice presidents. Quayle was prohibited from earning consulting fees, corporate salaries, or speaking income while in office. Any existing investments had to be carefully managed to avoid conflicts of interest, often through blind trusts or third-party asset managers. As a result, his net worth remained relatively stable during these four years, with little opportunity for substantial growth.

Despite the financial limitations, the vice presidency dramatically increased Quayle’s long-term earning potential. His role placed him at the center of global diplomacy, economic policy discussions, and high-level negotiations with corporate and international leaders. These experiences enhanced his reputation beyond partisan politics and positioned him as a credible advisor on government, defense, and economic matters.

Although Quayle did not accumulate significant wealth during his vice presidency, the position proved invaluable as a launching point for future financial success. The relationships built and expertise gained during this period became key assets once he transitioned into the private sector, where compensation structures were far more lucrative.

Transition From Politics to Private Wealth

After leaving the vice presidency in 1993, Dan Quayle entered a critical phase of his financial journey. Unlike his years in public office, this period offered far greater income potential and flexibility. Quayle was no longer constrained by government ethics rules, allowing him to capitalize on his political experience, global recognition, and extensive network of influential contacts.

One of Quayle’s first steps was repositioning himself as a trusted advisor rather than an active politician. His background in national security, economic policy, and international relations made him attractive to corporations seeking insight into regulatory environments and global markets. This shift marked the beginning of his transition from public servant to high-earning private-sector professional.

Quayle also became more involved in business strategy and investment opportunities during this time. Instead of relying on a single income stream, he diversified his earnings through advisory roles, corporate affiliations, and long-term investments. These moves allowed him to steadily grow his net worth while maintaining a relatively low public profile compared to other former vice presidents.

Perhaps most importantly, this transition period laid the foundation for his eventual role in private equity. By aligning himself with major financial firms and influential business leaders, Quayle positioned himself for compensation structures that included equity participation and performance-based rewards. These arrangements would later play a major role in the growth of Dan Quayle’s net worth.

This post-political transition demonstrates that Quayle’s wealth was not the result of government salary, but rather the strategic monetization of experience and relationships gained during his time in office. It represents the turning point where his financial trajectory shifted from stable to substantially upward.

Private Equity and Cerberus Capital Management

A major contributor to Dan Quayle’s net worth has been his long-standing involvement with Cerberus Capital Management, a global private equity firm known for investments in defense, manufacturing, financial services, and distressed assets. Quayle joined Cerberus as chairman of its Global Investments division, a role that significantly elevated his earning potential compared to traditional political or advisory positions.

At Cerberus, Quayle’s responsibilities extended beyond ceremonial leadership. He provided strategic guidance on geopolitical risk, regulatory policy, and international relations—areas where his experience as vice president proved especially valuable. His insights helped the firm navigate complex political environments, particularly in sectors heavily influenced by government oversight.

Compensation in private equity typically includes a combination of base pay, bonuses, and equity-based incentives. While Quayle’s exact earnings were never publicly disclosed, executives in similar roles often receive substantial long-term compensation tied to fund performance. This structure allowed Quayle to build wealth gradually but significantly over time, especially as Cerberus expanded its global footprint.

Beyond direct compensation, Quayle’s association with Cerberus enhanced his credibility within elite financial circles. This visibility opened doors to additional investment opportunities and advisory roles, further diversifying his income streams. Unlike short-term consulting work, private equity involvement provided sustained, compounding financial benefits.

Cerberus Capital Management marked a defining chapter in Quayle’s post-political career. It transformed his financial profile from that of a former public official into a high-level private equity executive. For many analysts, this role represents the single most important factor behind the substantial growth of Dan Quayle’s net worth in the decades following his vice presidency.

Speaking Engagements, Media Appearances, and Publications

In addition to private equity, Dan Quayle has generated income through speaking engagements, media appearances, and written work. Former vice presidents are often in demand as keynote speakers, particularly at corporate events, policy forums, and academic institutions. Quayle’s experience in government, national security, and global economics made him a credible and sought-after voice, allowing him to command substantial speaking fees over the years.

Media appearances also contributed modestly to his overall income. Quayle occasionally provided political commentary on major news networks and participated in panel discussions on public policy and international affairs. While these appearances were not as lucrative as private equity compensation, they helped maintain his public relevance and reinforced his value as a strategic advisor in the private sector.

Quayle is also an author, having co-written books that focus on American politics, leadership, and conservative policy principles. Although book royalties typically represent a smaller portion of a public figure’s earnings, they provided an additional revenue stream and further strengthened his personal brand. Publishing work also complemented his speaking career by enhancing his authority and visibility.

Unlike some former politicians who aggressively monetize their fame, Quayle maintained a relatively restrained public presence. This approach suggests that speaking fees and media income played a supporting role rather than serving as the primary driver of his wealth. Nevertheless, these activities contributed to the diversification of his earnings and reduced reliance on any single income source.

Together, speaking engagements, media work, and publications helped reinforce Dan Quayle’s post-political financial stability while supporting the steady growth of his overall net worth.

Investments and Real Estate Holdings

Beyond earned income, Dan Quayle’s net worth has been shaped by long-term investments and asset management strategies. Like many high-net-worth individuals, Quayle diversified his portfolio to preserve wealth while generating steady returns. His background in private equity and exposure to large-scale financial operations likely influenced a disciplined, long-term investment approach rather than speculative trading.

While specific details of Quayle’s investment portfolio remain private, it is widely understood that his holdings include a mix of equity investments, managed funds, and private ventures. These assets would have benefited from professional oversight, particularly during his years working closely with major financial institutions. This type of portfolio structure helps mitigate risk while allowing capital to grow over extended periods.

Real estate has also played a role in stabilizing his wealth. Quayle has owned residential properties in multiple locations, primarily for personal use rather than large-scale property speculation. These properties not only serve as tangible assets but also act as long-term value stores, appreciating steadily over time. Unlike commercial real estate empires built by some public figures, Quayle’s approach appears conservative and focused on capital preservation.

Importantly, Quayle has maintained a relatively low-profile lifestyle compared to other political figures with similar net worths. There is little public evidence of extravagant spending or high-risk financial behavior. This restraint suggests a strong emphasis on wealth preservation and legacy planning.

Taken together, Dan Quayle’s investments and real estate holdings complement his earned income from private equity and advisory roles. They provide balance and stability, ensuring that his net worth is supported not only by career earnings but also by prudent long-term financial management.

Estimated Dan Quayle Net Worth and Financial Breakdown

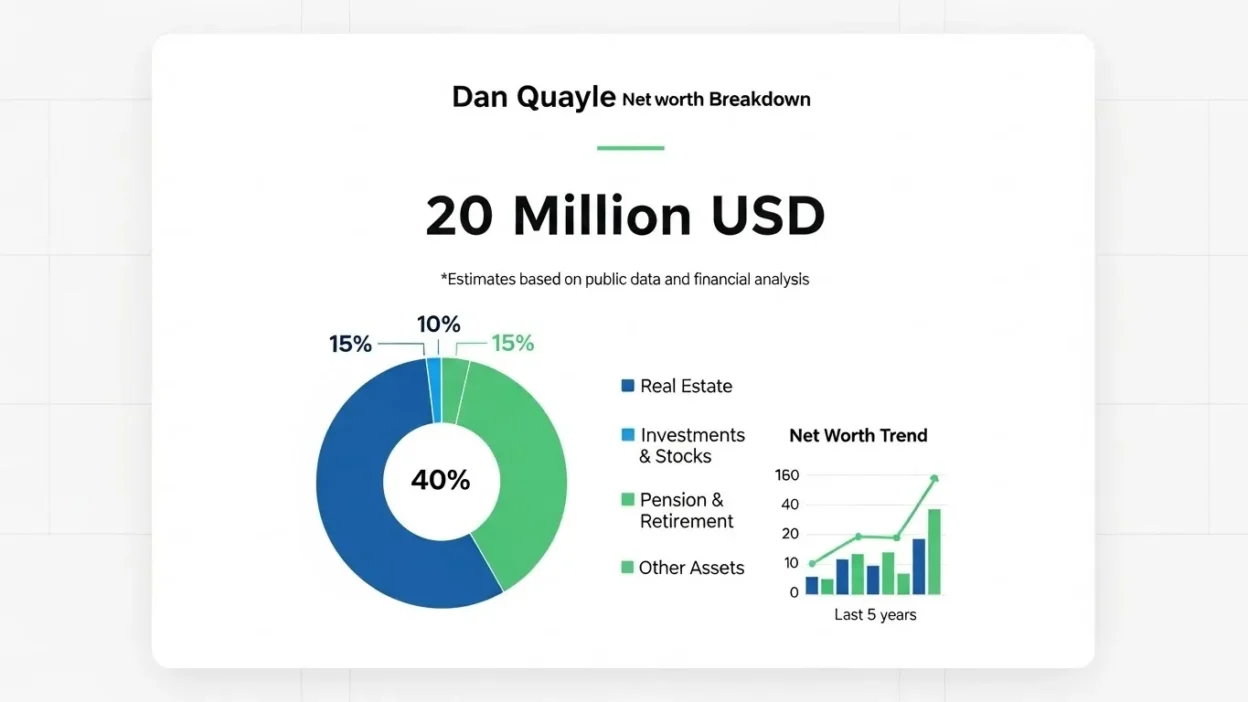

Estimating Dan Quayle’s net worth requires careful analysis, as he has never publicly disclosed an exact figure. Unlike current officeholders, former vice presidents are no longer required to file detailed financial disclosures, making precise calculations difficult. However, based on publicly available information, career history, and industry benchmarks, most financial analysts place Dan Quayle’s net worth in the tens of millions of dollars range.

The largest share of his wealth is widely attributed to his long-term role in private equity, particularly his leadership position at Cerberus Capital Management. Compensation at this level often includes base salary, performance bonuses, and equity participation, which can significantly increase net worth over time. These earnings far exceed what he made during his years in public service.

Additional portions of Quayle’s net worth come from advisory roles, board memberships, and investments accumulated over decades. While speaking engagements, book royalties, and media appearances contribute a smaller share, they still add meaningful supplemental income. His real estate holdings and diversified investment portfolio further strengthen his overall financial position.

It is important to note that net worth estimates can vary depending on assumptions about asset valuation, investment performance, and private equity returns. As a result, different sources may report slightly different figures. Nonetheless, there is broad consensus that Dan Quayle’s wealth was built primarily after politics, not during his time in government.

Overall, Dan Quayle’s net worth reflects a successful transition from public service to high-level private-sector leadership, supported by disciplined investing and long-term financial planning.

Net Worth Over Time and Comparison With Other Vice Presidents

Dan Quayle’s net worth has evolved significantly over the course of his career, with its most notable growth occurring after he left public office. During his early years in Congress and the Senate, his wealth increased gradually, largely in line with government salaries and conservative investments. While his vice presidency brought national prominence, it did not substantially increase his net worth due to strict ethics rules and limited earning opportunities.

The most dramatic rise in Quayle’s wealth began in the mid-1990s, following his transition into the private sector. His involvement in private equity and corporate advisory roles created new income streams that allowed his net worth to grow steadily over time. This period marked a clear shift from income stability to long-term wealth accumulation.

When compared to other former U.S. vice presidents, Quayle ranks comfortably among the more financially successful. Figures such as Al Gore and Dick Cheney also saw their wealth increase after leaving office, largely through media ventures, consulting, and private-sector leadership roles. However, Quayle’s path stands out for its emphasis on private equity rather than high-profile media or political activism.

In contrast, some former vice presidents relied heavily on book deals and speaking tours to build wealth, while Quayle maintained a lower public profile and focused on behind-the-scenes financial roles. This approach resulted in steady, compounding wealth growth rather than short-term income spikes.

Overall, Dan Quayle’s net worth trajectory reflects a disciplined, strategic approach to post-political life. His financial success places him among the wealthier former vice presidents, demonstrating how experience in public office can translate into long-term private-sector value when leveraged carefully.

Lifestyle, Spending Habits, and Philanthropy

Despite his substantial net worth, Dan Quayle has maintained a relatively private and conservative lifestyle compared to many high-profile political figures. He is not widely known for extravagant purchases, luxury collections, or highly publicized spending habits. This low-key approach has helped him preserve wealth over time while avoiding the public scrutiny that often accompanies conspicuous consumption.

Quayle and his family have primarily focused on stability rather than opulence when it comes to real estate and personal assets. His properties have served more as long-term residences than speculative investments, reflecting a preference for financial security over aggressive expansion. This restrained lifestyle aligns with his broader investment philosophy, which emphasizes long-term value and risk management.

Philanthropy has also played a role in Quayle’s post-political life, though much of his charitable activity has been conducted quietly. He has supported educational institutions, public policy organizations, and civic initiatives, often focusing on leadership development and conservative policy education. While specific donation amounts are not always publicly disclosed, his involvement suggests a commitment to giving back without seeking public recognition.

Public perception of Quayle’s wealth has evolved over time. Once primarily viewed through the lens of his political career, he is now more commonly recognized as a successful private-sector executive. His ability to maintain financial growth while avoiding controversy has contributed to a more balanced legacy.

Overall, Dan Quayle’s lifestyle and philanthropic efforts reinforce the narrative that his net worth is the result of careful planning, disciplined spending, and a long-term approach to wealth management rather than excess or short-term gain.

Conclusion

Dan Quayle’s net worth is the result of a long and carefully managed career that extends well beyond his time in public office. While his years as a congressman, senator, and vice president provided stability and national recognition, they were not the primary drivers of his wealth. Instead, Quayle’s financial success emerged after politics, when he strategically transitioned into private equity, corporate advisory roles, and long-term investments.

His involvement with Cerberus Capital Management stands out as the most significant factor in the growth of his net worth. Combined with board memberships, speaking engagements, and a disciplined investment strategy, Quayle built a diversified financial portfolio that continued to compound over time. Unlike some former political figures who rely heavily on media exposure or book sales, Quayle maintained a low public profile and focused on behind-the-scenes financial leadership.

Equally important is the way Quayle has managed his wealth. Conservative spending, private philanthropy, and an emphasis on long-term value preservation have helped protect his assets while supporting steady growth. This approach has allowed him to remain financially successful without attracting unnecessary controversy or public scrutiny.

In the broader context of American politics, Dan Quayle represents a model of post-government financial transition built on experience, credibility, and strategic positioning. His net worth reflects not only his earnings, but also his ability to leverage public service into lasting private-sector value. For readers seeking insight into how political careers can translate into long-term financial success, Quayle’s journey offers a clear and instructive example.